Pay stubs are not just simple numbers. They are financial documents and provide a shield for both the employer and employee. A properly made stub:

- Strengthens the relationship of trust between employers and employees

- Aid income verification of freelancers and contractors

- Helps in the loan application process

- Supports your rental approval efforts

- Enhances the accuracy of tax reporting

- Acts as evidence for disputes or audits

Mistakes in income documentation can result in delays, confusion, or even rejection of applications. Hence, the 123 Paystub Generator works on the production of pay stubs that are recognized by banks and other financial institutions as reliable.

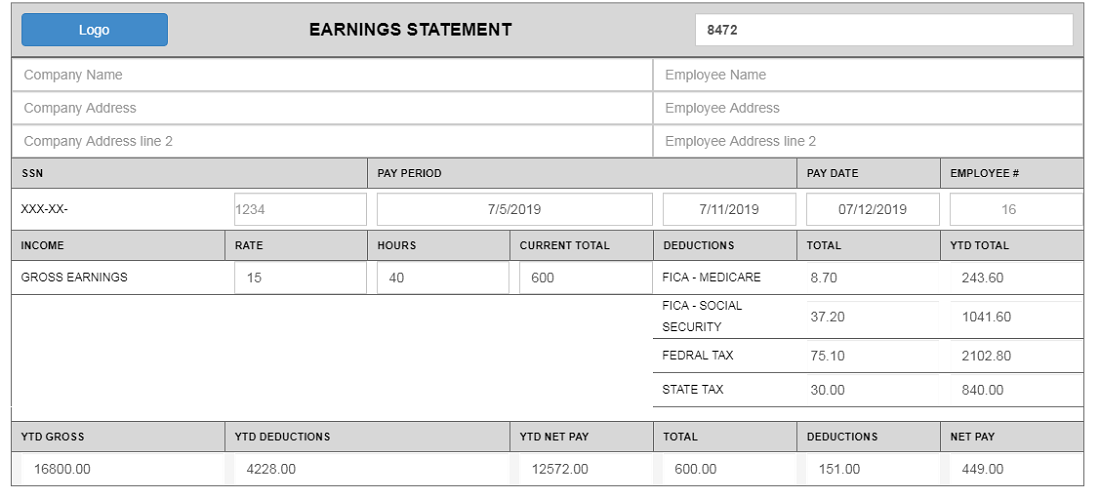

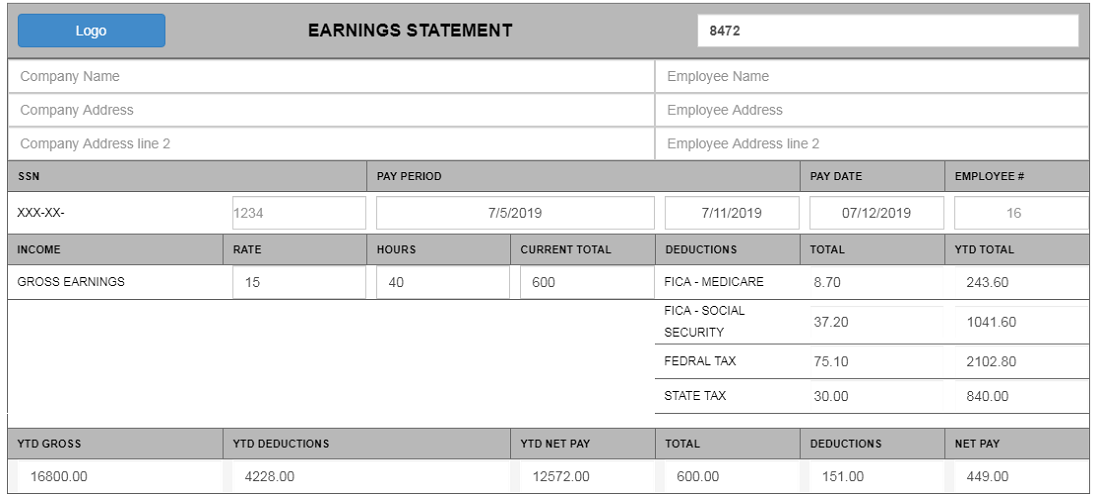

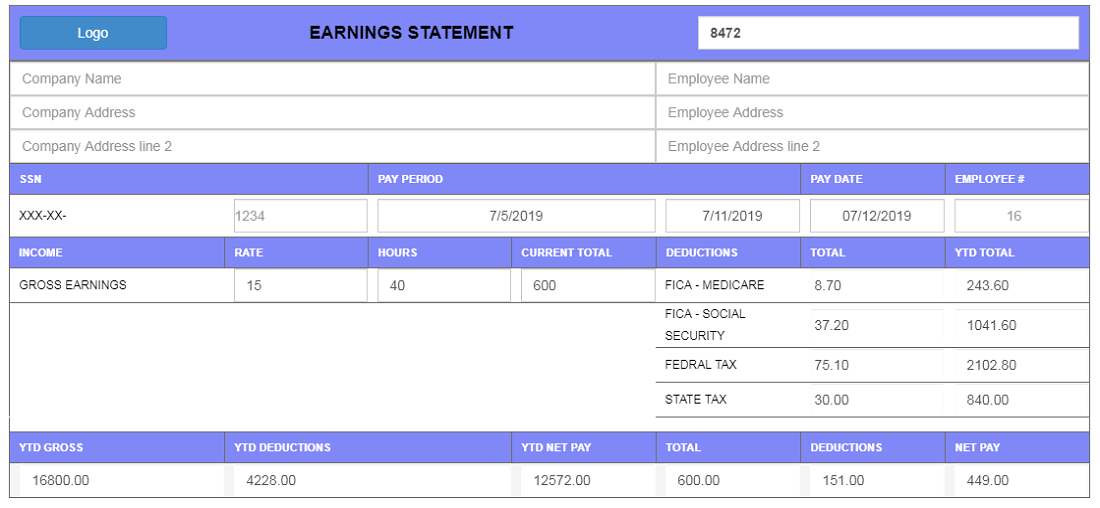

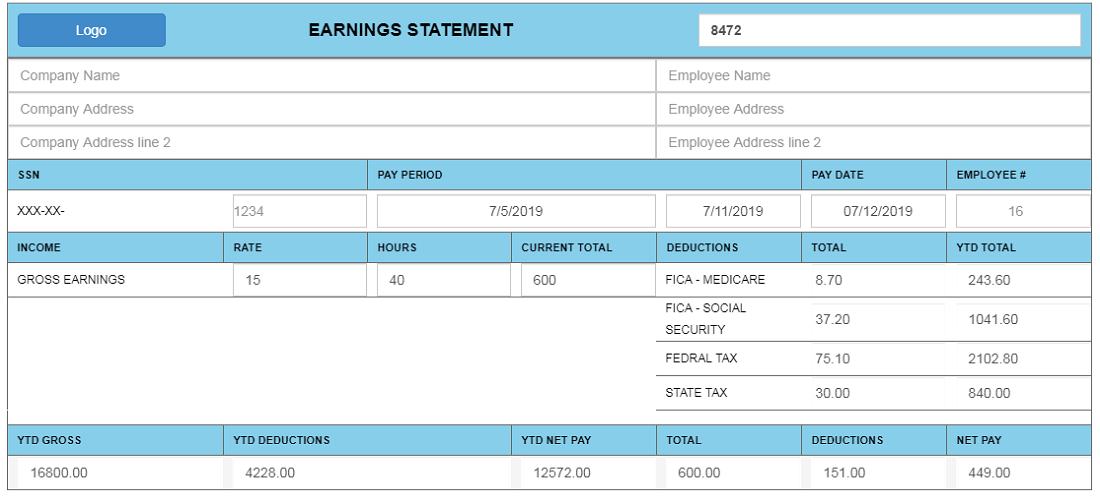

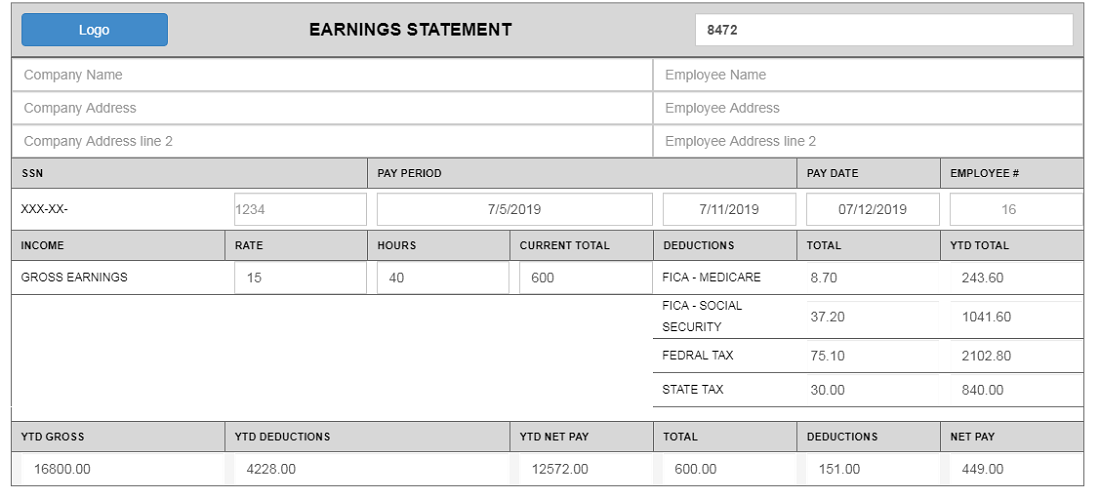

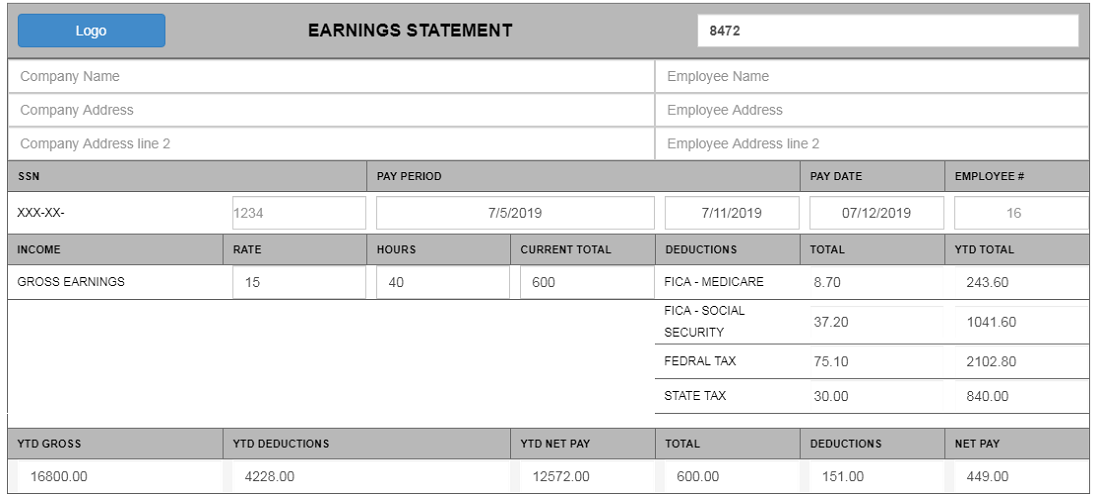

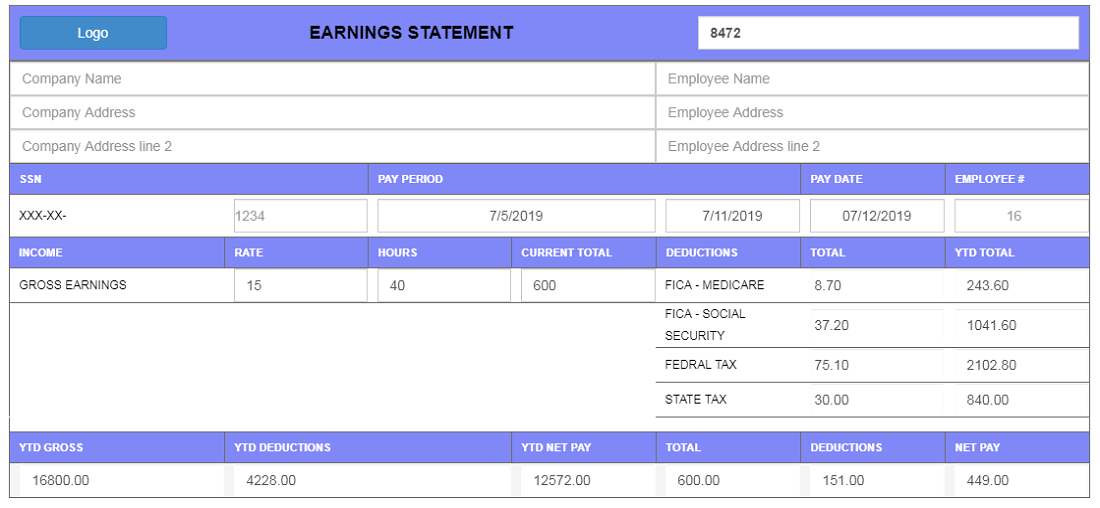

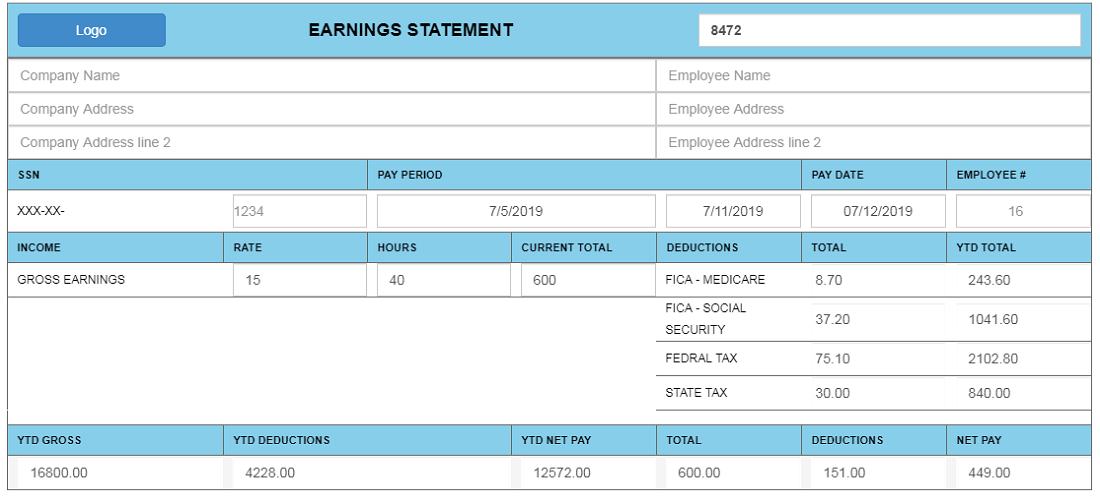

Sample Templates

SAMPLE

SAMPLE

SAMPLE

SAMPLE

SAMPLE

SAMPLE

SAMPLE

This is a sample paystub.

The watermark will be removed once you’ve made the payment.

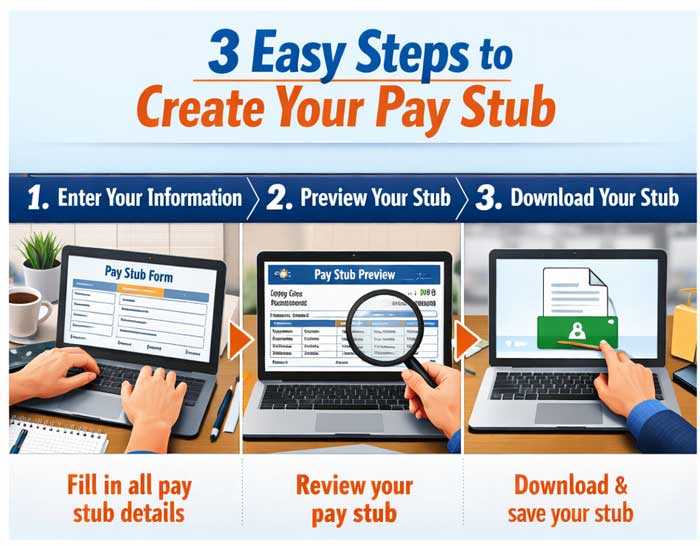

How the 123 Paystub Generator Works?

To use the generator, no accounting expertise is required. The whole process is pretty easy and won't take more than a few minutes.

Step 1: Enter Your Details

First, enter the data that should appear on the pay stub. The needed information is:

- Company name and address

- Name of employee or contractor

- Dates of the pay period

- Salary or rate per hour

- Hours worked

- Any overtime, bonuses, or commissions

- Any deductions like insurance or retirement contributions

All input is done via nice, simple fields that are easy to understand. The layout, even for first-timers, signifies that the process is simple.

Step 2: Select a Template and Preview

After that, choose a template from different styles. You can go for a very basic, neat one or very sophisticated one. A live preview is there to let you observe:

- Earnings

- Deductions

- Taxes

- Net pay

- Year-to-date totals (optional)

- Employer information

- Employee information

You can make corrections and changes to numbers and the template before finalizing. You can revise as many times as needed at no extra cost.

Step 3: Download or Print the Stub

When everything is correct, you can download the pay stub in PDF format. You can then decide to print it, email it, or PDFs maintain their format, making them ideal for banks, landlords, or HR teams.

Key Features That Make Our Paystub Generator Stand Out

The generator has equipped with tools destined to smoothen your journey and make it ever reliable.

Automated Tax Calculations

The tax manual computation is one of the major causes of errors in payroll. Our generator is here to ease your burden and thus it automatically applies:

- Federal income tax

- State income tax

- Social Security

- Medicare

- Any other withholdings that are to be done

The whole process is ensured to be accurate because the system is constantly updating itself and using current tax rules all the time.

A Wide Selection of Templates

Not all businesses look identical; therefore, pay stubs will not be the same everywhere. You have the option of choosing from various types of templates:

- Short formats

- Long formats

- ADP-style layouts

- Blue and white variations

- Black and white options

- Square templates

- Horizontal templates

All templates are devoid of clutter, easy to read and very professional.

Custom Branding Options

Would you like your business to appear as if it is well taken care of? Place your company logo on every pay stub. Branding is a sign of professionalism and thus it helps in creating trust amongst workers, lenders, and partners.

Flexible Download Options

You are allowed to download or print pay stubs on the spot. PDF format is necessary for the storage and sharing of the same through:

- Payroll systems

- Accounting platforms

- File storage apps

- Email systems

- HR management tools

Access to Important Tax Forms

Besides pay stubs, the service gives you access to:

and being able to prepare them too. Thus, you are going to be its handler during tax time.

24/7 Customer Support

Our support team will be ready to assist you every single day of the week and all hours of the day, in case you need help. It does not matter whether you are having a problem inputting the information or you are just not sure how to figure out a deduction, we will help you.

Moreover, you are allowed to alter your stub as many times as you wish before downloading it, so you will have the complete power over it without incurring additional fees.

Paystub Templates Tailored to Actual Requirements

It’s not only a matter of aesthetics when it comes to templates. They also minimize errors and give a better look to the documents. Every single template can be altered fully. No matter if you manage a small enterprise, a service firm, or you are a solo worker, there is a design that suits you perfectly.

You can also include additional fields like:

- Mileage reimbursements

- Project or job codes

- Special deductions

- Additional income types

This adaptability is very much appreciated by freelancers, contractors, and gig workers.

The 123 Paystub Generator at Whom?

The application is meant to be used by a large variety of people.

Owners of Small Businesses

The generator lets you produce neat and error-free slips, if you are already managing staff but without using a full payroll software system, it could be really easy.

Freelancers and Contractors

The proof of income is often demanded by banks, landlords, and agencies. If you are a self-employed person, this tool will allow you to produce official-looking documents that showcase your earnings.

Workers Who Requires More Than One Copies

At times, it is essential to reprint or make up a missing stub. Our tool can help you do it in no time.

Anyone Doing Financial or Legal Paperwork

Stubs are frequently required for:

- Loans

- Mortgages

- Rental applications

- Workers’ compensation claims

- Immigration paperwork

- Human Resources audits

Being able to produce clear and precise stubs can really help these processes go smoothly.

Generator’s Role in Transparency Enhancement

The pay stub will always feature a clear and understandable division of:

- Gross pay

- Pre-tax deductions

- Taxable income

- Taxes withheld

- Post-tax deductions

- Net pay

Thanks to the division of pre-tax and post-tax amounts, employees will be able to see exactly the path their money takes.

Common Errors Made by Individuals in the Process of Creating Pay Stubs

Errors in the manual creation of pay stubs are sometimes unavoidable. Here, let us enumerate the most common errors and also tell you how to easily avoid them:

- The Use of Incorrect or Fake Stubs

The stubs created by some online tools may appear to be real, however, they financially or legally might lead to problems since the figures provided are not accurate or misleading. Always resort to a reliable generator to have tax estimates correctly calculated.

- Wrong Dates for Pay Period

Using a wrong date might get the totals wrong and confusion during an audit is very likely. It is advisable to always check beginning and ending dates carefully before doing the pay calculations.

- Incorrect Hours or Overtime

Proper record-keeping is essential if you have hourly paid employees. To avoid errors, it is best to use time sheets or time tracking applications.

- Tax Tables That Are Not Up To Date

Daily changes take place in tax laws, and the generator's inability to update its calculations can yield wrong results. Our system is automatically updated.

- Insufficient Record Keeping

Offering payroll stubs in digital format is the best option. Keep your records, and organize your payroll files into monthly or yearly folders.

A Paystub Generator That is Real People-Friendly

The 123 Paystub Generator is a user-friendly and error-free application. When you need to show your income for personal reasons or have a business, the tool guarantees you timely, professional pay stubs. With the provision of customizable templates, precise tax calculations, and hassle-free downloads, everything needed to maintain your compliance and organization is made available without incurring extra costs on payroll software.