In the demanding world of personal finance, your documentation is your backbone. Whether you are applying for a mortgage, preparing your annual taxes, or simply tracking your budget, having clear, accurate, and professional records of your earnings is non-negotiable.

For any working individual, two documents stand above the rest: the Pay Stub (or Check Stub) and the W-2 Form (Wage and Tax Statement). While a pay stub is a record of a single pay period, the W-2 is the crucial annual summary required by the IRS.

Navigating the landscape of payroll can be complex. You might be juggling multiple jobs, working as an independent contractor, or running a small business trying to ensure compliance. This comprehensive guide will equip you with the knowledge needed to understand, manage, and, when necessary, replace these vital documents, demonstrating why utilizing a professional paystub and W-2 generator is the smartest financial decision you can make.

The Critical Importance of Pay Stubs and W-2 Forms

Understanding the function of each document is the first step toward financial mastery. They work together to paint a complete picture of your annual earnings and tax liability.

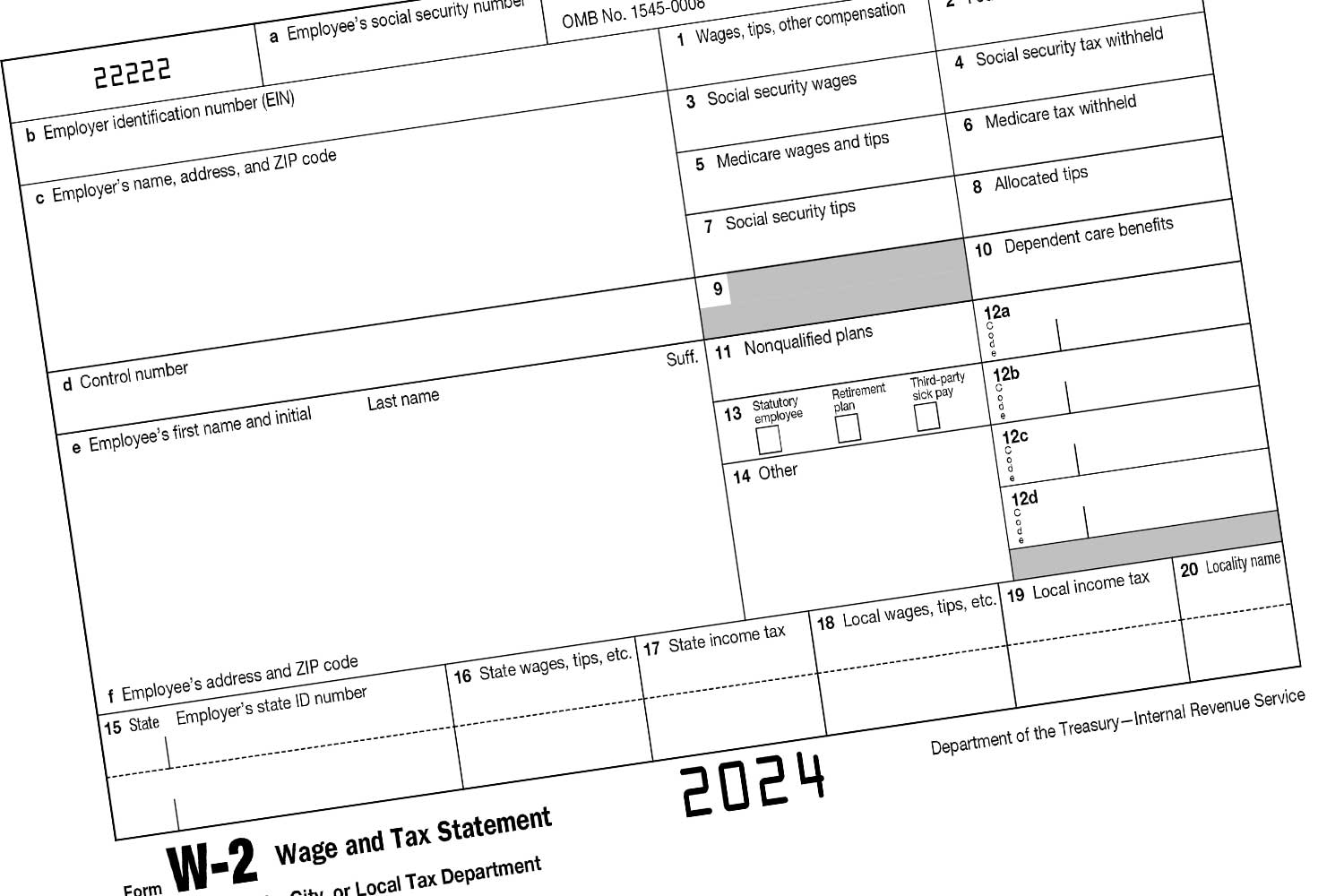

What is the W-2 (Wage and Tax Statement)?

The W-2 is the most important tax document you will receive as an employee. An employer is legally required to send this annual statement to you and file it with the Social Security Administration (SSA).

Its primary purpose is to provide a complete record of your:

- Gross Income and Earnings: The total amount you made before any deductions.

- Taxes Withheld: The amounts taken out for federal, state, and local income taxes.

- Deductions: Contributions to FICA (Social Security and Medicare), retirement, and other pre-tax or post-tax items.

The W-2 form is the cornerstone that allows you to accurately process and file your taxes with the Internal Revenue Service (IRS). Without it, calculating your final tax liability or refund becomes significantly complicated.

Why Your Pay Stub is Just as Essential

While the W-2 is an annual summary, a pay stub is a detailed record for each pay period. It acts as the necessary proof of income required for major life events and financial transactions throughout the year.

- Proof of Income for Loans: Financial institutions, including banks and credit unions, require recent pay stubs when you apply for a personal loan, an auto loan, or a mortgage. They use this consistent record to verify your capacity to repay the debt.

- Rental Applications: Landlords and property management companies nearly always request several recent pay stubs to confirm that you have a stable income and can afford timely rent payments.

- Budgeting and Record Keeping: Pay stubs are invaluable for personal finance management. They help you track your net pay (take-home money) and monitor how much is being contributed to deductions like insurance and retirement, making budgeting easier.

For both employees and employers, producing a professional and accurate pay stub at the end of every pay period is not just a formality—it’s a requirement that demonstrates professionalism and compliance.

Essential Data: What Makes a Pay Stub Professional and Compliant?

When creating a pay stub, accuracy and compliance are paramount. The information requested on a valid pay stub document is legally necessary and cannot be customized or omitted. The difference between a real, formal document and a “fake-looking” one often comes down to the completeness and accuracy of its data fields.

To be considered legally sound and accepted as proof of income, a pay stub must accurately display the following mandatory components:

-

Company Information

The pay stub must clearly identify the payer. Ensure you include:

- The full legal company name.

- The complete company address and contact details.

- The Employer Identification Number (EIN) or other required license numbers.

-

Employee Information

This section validates the recipient of the payment.

- The employee’s full legal name and current address.

- Employee ID number or Social Security Number (SSN).

- Additional details such as marital status and the number of withholding allowances claimed on the W-4 form.

-

Income Details

This is the core financial breakdown of the pay period.

- Pay Period Dates: The start and end dates of the pay period and the payment date.

- Gross Pay: The total earnings before any deductions are taken out.

- Net Pay: The final ‘take-home’ pay after all deductions and taxes.

- Year-to-Date (YTD) Totals: This is essential for all earnings and deductions, showing the cumulative totals for the calendar year to date.

-

Deductions and Taxes

This section must be as descriptive and accurate as possible, detailing all amounts withheld.

- Federal Income Tax withheld.

- State Income Tax withheld (and any necessary local or city taxes).

- FICA deductions, which cover Social Security and Medicare.

- Any other pre-tax or post-tax deductions (e.g., retirement plan contributions, health insurance premiums, garnishments).

Design and Format: While the data is mandatory, the visual appearance matters. A professional template that looks totally real and formal will be accepted by institutions, unlike documents created using simple tables in word processing software or spreadsheets that lack the necessary layout complexity and detail.

A Pay Stub for Every Need: Exploring Template Varieties

A check stub template can differ in style, design, and paper format, but never in the data it presents. Choosing the right template can add an extra layer of professionalism, especially when presenting the document for formal verification.

Professional Design Options

Modern pay stub generators offer a wide selection of pay stub example forms to suit various preferences:

- The Basic Stub: Simple, minimal, and excellent for all basic needs, containing all the necessary information about the pay period, hours worked, and net earnings.

- Short vs. Long Formats: Short formats are often designed to be printed on standard check paper, resembling the stub attached to a physical paycheck. Long formats are typically printed on standard letter paper (8.5″ x 11″) and can accommodate more line-item details.

- Color and Style: Templates are available in classic colors like blue or professional black & white print formats. Some popular templates mimic widely used payroll provider layouts, such as the ADP-like Paystub Template.

- Square Paystubs: A modern, rectangular layout that clearly presents all payment details, often including the employee’s full address and detailed payment breakdown.

Paper Types and Delivery

Believe it or not, the paper type can also vary when printing a pay stub template:

- Software Compatible: Designed to work seamlessly with electronic payroll software.

- Business Checks: Printed on specific paper that meets security specifications and conditions, pairing perfectly fine with financial institutions.

- Standard Paper: A simple A4 sheet of paper is perfectly acceptable for designing or printing your pay stub template, as long as it contains all the necessary information.

- Electronic Pay Stub: The most common and efficient option. Using a professional generator allows you to go digital, removing the headache of manual design. All you need to do is fill in the necessary fields, and the document is delivered instantly as a printable PDF, with the option to email it directly.

When Documents Go Missing: Your Step-by-Step Guide to Getting a Replacement W-2

As the tax deadline approaches, not being able to trace your W-2 form can cause panic. Whether you misplaced it, it was mailed to an old address, or you simply haven’t received it yet, there are clear, straightforward options available to you.

Remember: As a legal requirement, your employer should mail your W-2 form by January 31st to allow you enough time to meet the tax filing deadline in April.

Step 1: Check Online Portals and Emails

The quickest way to find your W-2 is often through an electronic portal.

- Company Portal: Many employers now issue W-2s electronically. Log in to your company’s online portal to access and download it.

- Check Inboxes: Look through your personal and work email inboxes. Due to cybersecurity concerns, companies often send a link to an online service (like the Securitas ePay portal for Securitas employees) where you can securely access and download the PDF yourself. Don’t forget to check your spam or junk folder, as the notification email may have ended up there.

Step 2: Contact Your Employer Directly (HR/Payroll)

If the online options are unavailable, or you can’t trace the electronic copy, reach out to your former or current employer’s payroll or HR department.

- Sending a Letter: State the issue clearly. In many cases, the W-2 document was simply misplaced or mailed to an incorrect location.

- Mailing Issues: If you moved, the post office may have returned the W-2 to your employer. Most companies keep a duplicate copy and can easily send it to your current, corrected address.

Note: The IRS highly recommends using your employer as the first point of contact before raising issues with them.

Step 3: Contact the IRS Directly (The Last Resort)

If your employer is unresponsive, out of business, or simply unable to replace the form, your next step is to contact the Internal Revenue Service. It should be at least until the end of February before you raise issues with them.

To request help from the IRS Tax Assistance Center (TAC), you should be prepared to provide the following information:

- Your Personal Information: Your name, Social Security Number (SSN), phone number, current address, city, state, and zip code.

- Employer’s Information: The employer’s name, phone number, and Tax ID (if available).

- Employment Period: The duration you were employed during the tax year.

- Estimated Earnings: Approximate wages earned, total withholding tax, and time worked. You can gather these estimates from your last pay stub or earning statements.

The IRS Transcript: If the IRS cannot trace the original W-2 sent to your employer, they will not issue you a duplicate copy. Instead, they will provide a Wage and Income Transcript, which contains all the tax information your employer reported to the SSA for that tax year. This may take up to 10 days to receive after you submit the request.

Filing Taxes Without a W-2: What to Do Before the April Deadline

If you have exhausted all options and the tax deadline is looming, you still have alternatives. As per the IRS requirements, you must either process your returns or request an extension.

-

File a Substitute Form (Form 4852)

If you have already contacted the IRS and notified them of your missing W-2, you are required to fill out Form 4852, the Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. You can easily access this form from the IRS website. This form uses your estimated wage and tax information.

-

Request an Extension (Form 4868)

If you need more time, you can file Form 4868, which grants you up to six more months from the April deadline to file your tax returns.

Crucial Caveat: An extension is only for filing your return forms and not for delaying paying any tax that you owe. For the extension to be effective, you must accurately estimate your total tax liability and pay that estimated amount by the original filing deadline. Any tax refunds filed through estimations can take a long time to process, as the IRS needs time to verify the information against its records.

Amending Your Return

If you proceed with your tax return without your W-2 and later discover that you misestimated your earnings, you must make corrections. To amend your returns, you must use Form 1040X, the Amended U.S. Individual Income Tax Return. Be aware that amending your returns can impact your refund, and the process can take up to 16 weeks to reflect the changes.

The Future of Payroll: Why Use a Professional Paystub and W-2 Generator?

In a world where time is money and accuracy is crucial, relying on a professional online generator is the most efficient solution for individuals and businesses alike.

-

Eliminate Human Error and Ensure Accuracy

The most significant advantage is the elimination of common human errors found in manual entry. Professional systems are engineered for financial accuracy.

- Automated Calculations: All complex federal, state, and local tax deductions, as well as FICA/Medicare, are calculated automatically by in-house accountants. You are guaranteed a document with zero errors.

- Accurate Forms: For employees who need a W-2, the generator creates the complete document with all the necessary information, removing the guesswork involved in complex tax forms.

-

Speed and Efficiency

Manual payroll takes hours. A generator takes minutes.

- Instant Delivery: You simply select the pay stub example of your choice and fill in the necessary information. The final document is generated instantly and available to download as a printable PDF.

- Easy Payroll for Businesses: Using a generator allows employers to provide their employees with the required information quickly and professionally, exhibiting a dedication to quality and professionalism.

-

Comprehensive Compliance and Record Keeping

Professional generators are designed to maintain all legal standards.

- Mandatory Data: They force you to include all legally required information for compliant pay stubs, including company details, YTD totals, and itemized deductions.

- Support for Other Forms: Beyond pay stubs, the best tools also provide W-2, 1099-MISC, 1099-NEC, and other essential forms, which are especially useful for self-employed individuals and contractors who need to track and report their income correctly.

Conclusion: Be Prepared for Tax Season and Financial Milestones

Your employee and income documents are essential keys to navigating your financial life, from managing a household budget to securing a new apartment or loan. You never need to worry too much if a W-2 or pay stub is misplaced, as multiple straightforward options—from online portals and employers to the IRS—are available to trace or replace them.

However, the best solution is always preparation. By utilizing a professional Paystub Maker and W-2 Generator, you ensure that you possess accurate, compliant, and professional-looking documentation instantly. This empowers you to stay prepared for tax season and confidently handle any financial verification required, giving you peace of mind and demonstrating the utmost professionalism in your financial affairs.