If you’re a small business owner, freelancer, or a contract worker in the United States, at some point, you will need a paystub. Whether you need to show proof of income for a mortgage, car loan, or even to rent a new apartment, you will need some official documentation.

You probably came across two different options during your search: the complicated, full-range services of a big company like ADP or the simpler, low-cost alternatives like Paystubmakers.com.

You are searching the term “ADP paystub generator vs. affordable online paystub tools” because you want the accuracy and professionalism of a big company without the price and commitment of a monthly subscription.

This guide is designed to help you understand these two options for the financial year 2024-2025. We will show you the hidden costs of payroll all-in-ones and explain why highly specialized secure online generator tools are the reasonable and modern solution to your business requirements.

The Hidden Cost of the All-in-One: Breaking Down the ADP Paystub Generator

ADP had and still has a finely tuned payroll system. ADP was responsible for every component and workflow concerning the management and processing of payroll. When ADP generates a paystub after payroll has been processed and payroll taxes have been adjusted, it is just the final step of a much more complex system.

The True Value of ADP Payroll

ADP is a payroll industry giant for a reason. They have built a very extensive system that handles every administrative payroll task provided for small businesses (1-49 employees) and manages every aspect of employee management, from onboarding all the way to tax filing at the end of the year! And, of course, from their system and the services provided, a paystub is created.

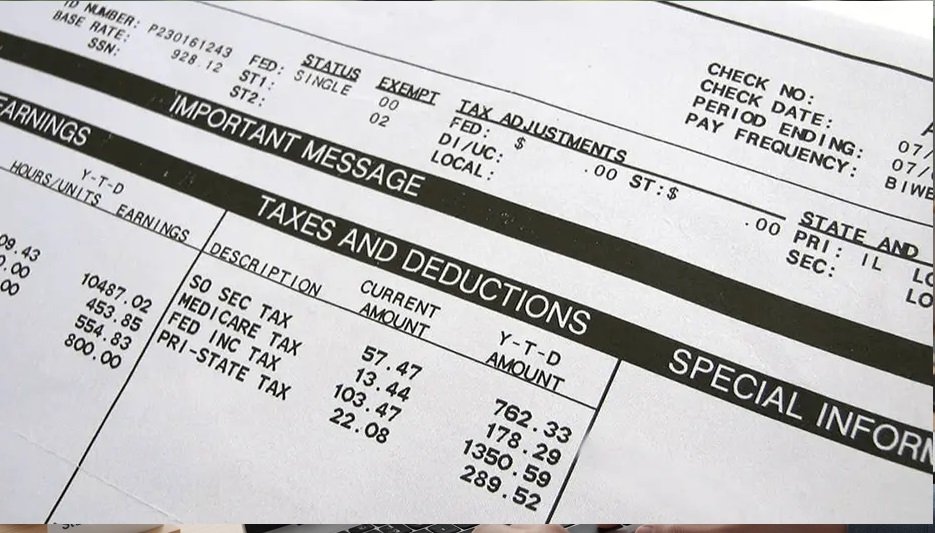

ADP systems generate and assign paystub creation to the end of the payroll procedure. Payroll processing and payment management ownership and accountability statements follow the creation of the paystub. These include, tax filing, and payment management, IRS compliance, management and W2/1099 documentation for employees.

Why Is the Paystub So Expensive?

Because the paystub is bundled, you can’t buy it separately. If you need just one paystub in a month for yourself or a contractor, you must still subscribe to the entire payroll service.

Pricing estimates for small U.S. businesses for the next couple of years show:

High base monthly fee: For basic platform access, it’s typically $59 to $100+ a month

Per employee or contractor fee: Expect $4 to $10 more for each employee per month.

Implementation costs: These are usually one time, and the amount you’ll pay will depend on the setup complexity but will likely be hundreds or thousands.

Setup costs and ongoing monthly fees can feel excessive. For a sole proprietor or a micro business with one part-time employee, it will likely feel like a major expense just to get professional paystubs and basic tax handling. If you’ve already done your taxes, the monthly fee is certainly an overkill, especially with the number of contractors you are paying.

The Best Option for Today’s Economy: Cheap Online Paystub Tools

Because of the gig economy’s growth, there is an increased need for cheap online paystub tools. Companies like Paystubmakers.com appreciate the need for streamlined services and focus on one thing: producing an accurate, professional, and compliant paystub PDF.

Paystubmakers.com: Pay As You Go and No Regular Fees

The best thing about online generators is that there is a pay-as-you- go system. This means that there is no overpriced, monthly subscription, and you simply pay a small, one-time fee whenever there is a need to generate a document. This is why we are the cheapest paystub generator option for many Americans.

Use Case 1: The American Freelancer and Contractor (1099)

In 2024, the gig economy will employ more than 60 million people. Lenders, landlords, and banks still prefer a W-2 style paystub for 1099 workers, as it is a structured document that clearly outlines the income.

1. The Problem: Freelancers don’t receive paystubs for their standard pay. They get a gross amount and pay all taxes and, to prove income for a loan, they need a statement that is more professional than a bank statement.

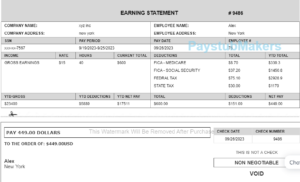

2 . Solution: The contractors enter their gross earnings in Paystubmakers.com and then the contractors paystub makers calculates the self employment taxes. These include social security, medcare, and self funded retirement and health components, Then the contractors paystub makers creates a professional income statement that looks exactly like a W-2 paystub. This provides the lender the verification format that they trust.

Use Case 2: The Micro-Business Looking For Low-Volume Compliance

You are a small coffee shop owner on a coffee shop consult with one or two part-time W-2 employees. You may use an outside CPA for tax filing or pay taxes by yourself via the IRS EFTPS system. You just need it for the document that you provide to your employee to satisfy the state law.

1. State Compliance in 2024 2025: 2024 and 2025 Compliance to US states including New York and California, employers must provide state paystubs. This professional online tool will ensure you accurately itemize and meet these requirements.

2. Cost Control: This can save you hundreds of dollars annually rather than a full payroll subscription service. With a single $10 EPS as opposed to a subscription at 79 and she$ for as many stubs as you want in a pay period you save almost 10$ stubs. 2 pay periods a stash saves almost a quarter a month. Trace that over a year for a couple of stubs that saves hundreds of dollars.

The Key Advantage: Current Tax Calculations

One of the biggest mistakes for small business owners to accomplish is trying to create their paystubs using a self-made Excel sheet or using a free paystub template which is non-compliant. This is where the mistakes come in which leads to errors.

Affordable professional online paystub tools such as Paystubmakers.com must comply with all U.S. payroll laws which is a huge and ongoing task. For the year 2024 and 2025 this includes a number of things which will be discussed.

1 . Paying attention to Federal Tax Withholding Tables: This includes the accurate calculation of Federal income tax which is based on the latest W-4 forms and Federal tax withholding.

2 . Paying attention to FICA Taxes: This includes the calculation of social security and Medicare taxes as well as paying attention to the annual wage base limit and balance.

3 . Paying attention to different State and Local taxes: This includes automatically adjusting withholding for the different state income tax rates and the local taxes of New York City, Philadelphia, and the various Ohio cities.

The professional service you’re purchasing includes all of these regular updates and precision. You receive all the accuracy and compliance elements of a full payroll service, minus benefits administration, time-tracking modules, and other features you don’t need or manage elsewhere. The end product is a professional, clean, and legally sound document you can generate from any device for a small fee. Because of this focus, the service is much faster and easier to use than a complex payroll dashboard, which is cumbersome to navigate and meant for hundreds of employees.

Paystubmakers.com vs. ADP

To put it simply, the choice is Managed Service or On-Demand Document. Here’s a process and cost comparison for generating a paystub.

| Feature Comparison | Full-Service Payroll (e.g., ADP) | Affordable Online Tool (e.g., Paystubmakers.com) |

| Pricing Model | High Fixed Monthly Subscription + Per-Employee Fee. | Low One-Time Fee per paystub (Pay-as-you-go). |

| Tax Filing | Automatically handled and remitted to authorities. | Calculated accurately, but manual remittance is required by the user. |

| Setup Time/Difficulty | High. Requires bank verification, tax account setup, and full onboarding. | Low. Enter basic details, generate in under 5 minutes. |

| Best For | Growing businesses (10+ employees) needing HR, benefits, and guaranteed tax filing. | Freelancers, 1099 Contractors, and micro-businesses (1-5 W-2/1099) needing proof of income. |

| Customization | Very rigid, templated paystubs required by the corporate brand. | High flexibility: multiple templates, custom logo upload, and personalized earnings/deductions. |

| Accessibility | Requires a registered account login (often via app or dedicated portal). | Instant PDF download; no sign-up or long-term account required. |

The Value Equation When Does the Calculator Win?

Let’s dive into it. Looking at the most simple example, a one-person business that needs to generate a paystub twice a month, that’s 24 paystubs a year.

- ADP Cost Estimate: $79 (Base Fee) x 12 Months = $948+ a year.

- Paystubmakers.com Cost Estimate: $5.99 (Avg. Cost) x 24 Stubs = $143.76 a year.

That’s over $800 of savings. For a user who needs a recorded, professional, and accurate document of income proof, this is a great option.

FAQs for US Paystub Users

Q: Is it legal to use a paystub generator for proof of income?

A: Yes it is. You are able to legally create a paystub using a professional paystub generator like Paystubmakers.com as long as the info you put in (wages, hours, hours worked, deductions) is accurate. Everything you entered pays for the generator to do the calculations needed and format the paystub. The only illegal thing you could do is falsify your income to a bank, landlord, or government using the paystub to misrepresent your income. Using a trustworthy tool helps to keep legal as the computations are correct.

Q: How much does ADP charge for paystubs?

A: ADP does not charge for paystubs individually. Paystub generation is a feature of the full payroll service. As of 2024, the minimum for an ADP plan (for a small business) is about $59-$79 a month, and that’s just the base price, plus more for each employee. The cost to “get an ADP paystub” is the annual subscription price for full payroll service. You do not pay for it a paystub individually.

Q: What is the cheapest paystub generator that includes accurate tax calculations?

A: The lowest cost paystub generators that offer accurate tax calculations are those that use a pay-per-stub model, where the user pays a low flat rate per document, usually under $10. For instance, Paystubmakers.com is one of the cheapest because it emphasizes quick turnaround and instant download, using modern, accurate tax calculations and bypassing the costly payroll suite overhead.

Q: To use an online paystub creator, do I have to have a W-2 or a 1099?

A: You do NOT need a W-2 or 1099 for paystub creation. Paystubmakers.com covers both situations:

- For W-2 Employees: You provide the gross wages, and the tool will figure out Federal and State withholding, FICA, and other average deductions.

- For 1099 Contractors/Self-Employed: You provide your gross income, the tool will compute the estimated income/self-employment tax withholding, and will generate a professional Income Statement for your organized record-keeping or income verification.

Conclusion: The Professional Solution That Fits Your Budget

The small business owner and independent worker is forced to choose between two sub-optimal and risky options. Manually creating an error-prone, and likely, poorly designed payroll spreadsheet or shelling out big bucks for a full service payroll suite is frustrating.

The preferred choice for 2024 and 2025 remains the reliable, cost-effective, online paystub generator. You don’t need a complicated human resource system. When the goal is a paystub that is secure, accurate, and professional, all you require is a system that provides the new tax tables and offers quick, readable templates. It should also allow instant access.

This is why we created Paystubmakers.com. You gain the precision of a complex payroll calculator without the monthly subscription. You save time by eliminating all the excessive monthly fees and save facilities for verification that should be proof compliant. You should only pay a small fee for the access you require twice a month.

✅ Begin now and create a professional paystub in minutes: Paystubmakers.com