Managing personal finances can start with knowing a person’s paycheck at the very beginning. If one is a full-time employee, a freelancer, or a small business owner, knowing how much take-home income he has becomes a primary requirement to budget and financially plan. Free paycheck calculators make the task easy-there’s a pretty good estimate of the gross that you’ll have after taxes, deductions, and other withholding.

Here, we will look at how paycheck calculators typically work within payroll, why they are very important, and how they can help any individual and businesses to streamline managing payroll.

What is a Paycheck Calculator?

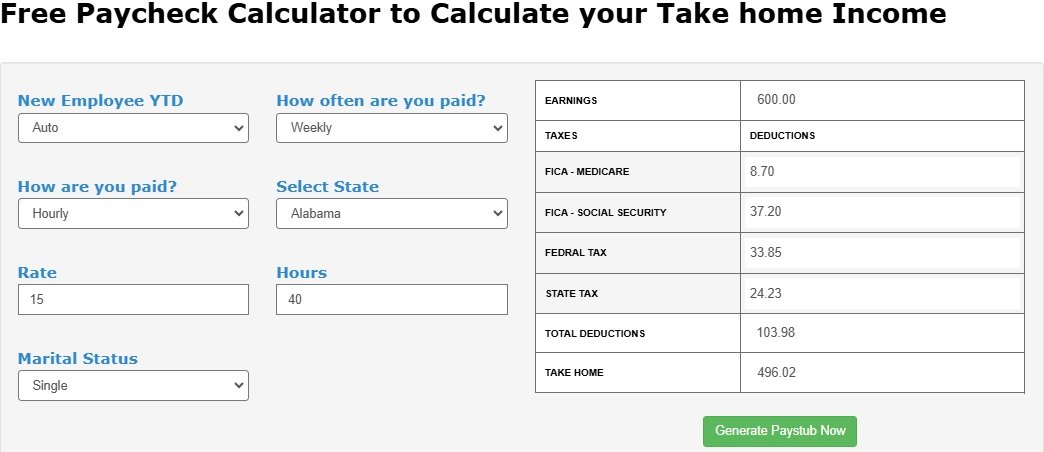

Such a tool is designed to determine the net amount to be earned after federal, state, and local taxes have been deducted from one’s gross earnings. Also anesthetized will be the self employment taxes entailing all related deductions to social security, medicare, retirement contributions, and many more. When you input your salary, how often you are paid and your status for filing, boom-your paycheck appears before payday.

This is very useful for both employees and employers:

for the employee to verify their earnings against employer records, and for the employer to estimate labor costs for payroll before running payroll.

How Does Free Paycheck Calculators Work?

A paycheck calculator follows several simple steps in order to give you suitable results that can guide you between your gross pay and net pay.

- Gross Pay Input : Your gross pay is your total earnings before taxes and deductions.

- For hourly paid employees, you will enter your hourly wage and the number of hours worked.

- For salaried employees, you just need to input your annual salary divided by your pay frequency that may be weekly, biweekly, semimonthly, or monthly.

- Pay Frequency Selection :

- Weekly: 52 paychecks per year

- Biweekly: 26 paychecks per year

- Semimonthly: 24 paychecks per year

- Monthly: 12 paychecks per year

- Income Tax Peach Filing Status : Your tax withholdings depend on your filing status:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Federal, State, and Local Taxes Applied : The calculator applies current federal tax rates based on your income bracket. It also calculates withholding for state taxes if you’re in a state with an income tax. Some cities have local taxes that also get withheld from your paycheck.

- Include Deductions and Contributions :

- Social Security and Medicare (FICA Taxes): Automatically deducted at 6.2% for Social Security and 1.45% for Medicare.

- Retirement Contributions: This will minimize taxable income for those who make contributions to 401(k) or IRA accounts.

- Health Insurance and Other Benefits: If the employer has deducted money for health insurance, life insurance, or commuter benefits, these will be captured as well.

- Finally, view Net Pay (the Take Home Pay) : After applying all the deductions and taxes, the calculator will give an estimate of the amount which you will receive on payday.

Why Paycheck Calculator Free?

There are several advantages for employees and employers when using a paycheck calculator:

For Employees :

- Know Your Paycheck: Find out how much is your take-home pay after tax deductions.

- Plan Your Budget: Helps with the financial plan by giving an overview picture of income.

- Estimating Changes: Assess how pay increases, bonuses, or benefit deductions affect pay.

- Verify Payroll Accuracy: Ensure you are paid as appropriate and tax withholdings are correct.

For Employers :

- Calculate Labor Costs: Help firms estimate payroll costs processes before payday.

- Tax Compliance: Avoid under-or overpayment handling of payroll taxes.

- Benefit Planning: Employers may use pay estimates to build compensation packages for their employees.

Payroll Deductions Commonly Explained

A paycheck calculator rates many deductions. These are:

- Tax Federal : According to the IRS tax brackets and statuses of filing.

- The amount of withholding is determined by the W-4 form submitted by employees to the employer.

- State Income Tax : Varies by a state; for example, Texas and Florida do not have income taxes.

- Paycheck calculators adjust automatically depending on selected state.

- Social Security and Medicare (FICA Taxes) : Social Security: 6.2% on earnings up to $168,600 in 2024.

- Medicare: 1.45% on all salary plus an additional 0.9% over $200,000 incomes.

- Contributions for Retirement : 401(k) contributions reduce taxable earnings.

- Some offer matching contributions.

- Health and Insurance Deductions : Before tax deduction of premiums for medical, dental, and vision coverage.

- Either may also have life and disability insurance included.

- Other Deductions : Examples are union dues, wage garnishments, and commuter benefits.

Payroll Taxes in a Nutshell by States

The U.S. has wide variations of payroll taxes. Some major ones include the following:

- No State Income Tax: Texas, Florida, Nevada, Tennessee, Washington

- Most Taxed State Income: California (up to 13.3%), new York (up to 10.9%)

- Local Payroll Taxes: Income taxes charged by some cities at a local level such as New York City and Philadelphia.

A paycheck calculator automatically adjusts calculations based on your location to provide an accurate estimate.

How a Paycheck Calculator Works in Financial Planning

It helps in more long-term financial planning other than knowing about your next paycheck:

- Saving for retirement : Solutions are acquired by manipulating both the 401(k) or the IRA contributions within the calculator. Use this to see projected savings and effects on take-home pay.

- Tax Planning : Taxation can be based on withholding adjusted by W-4.

- Budgeting for Expenses :Net pay will thereby be important for planning rent, groceries, utilities, and savings goals.

- Job Offers Comparison : A paycheck calculator compares salaries after taxes and deductions when considering a new role.

Frequently Asked Questions (FAQs)

-

How accurate is a paycheck calculator?

It gives estimates based on tax rates and deductions that are open up to date. Though quite accurate, the actual amount may differ from estimates due to deductions made by the employer or other payroll adjustments.

-

Are tax rates entered manually?

No, most paycheck calculators automatically take today s federal and state tax rates as well as all you enter into them.

-

Can I use a paycheck calculator for my self-employment income?

A traditional paycheck calculator is only for using by W-2 employees. However, you should turn to the self-employment tax calculator for self-employed individuals because they have to calculate extra tax liability not applicable to W-2 employees.

-

How often should I calculate my paycheck estimate?

Check with a paycheck calculator whenever you have changes in your salary, changes in tax laws, changes in deductions, or changes in filing status. It should keep your budgeting accurate.

-

Are paycheck calculators free?

Yes, most of them happen to pay you free for online paycheck calculators to allow everyone who wants to estimate net pay to come aboard.

Conclusion

Free paycheck calculators are key tools in giving accurate estimates on take home pay for employees and employers alike. Whether budgeting for personal finances or maybe even retirement, or even payroll for a business, using a paycheck estimator keeps you knowledgeable and primed for the future. Make sound financial decisions by becoming versed in payroll deductions and tax withholdings as well as pay frequency so that your income meets expectations instead of being a surprise. Use a paycheck calculator today and seize the confidence of control in managing one’s finances.