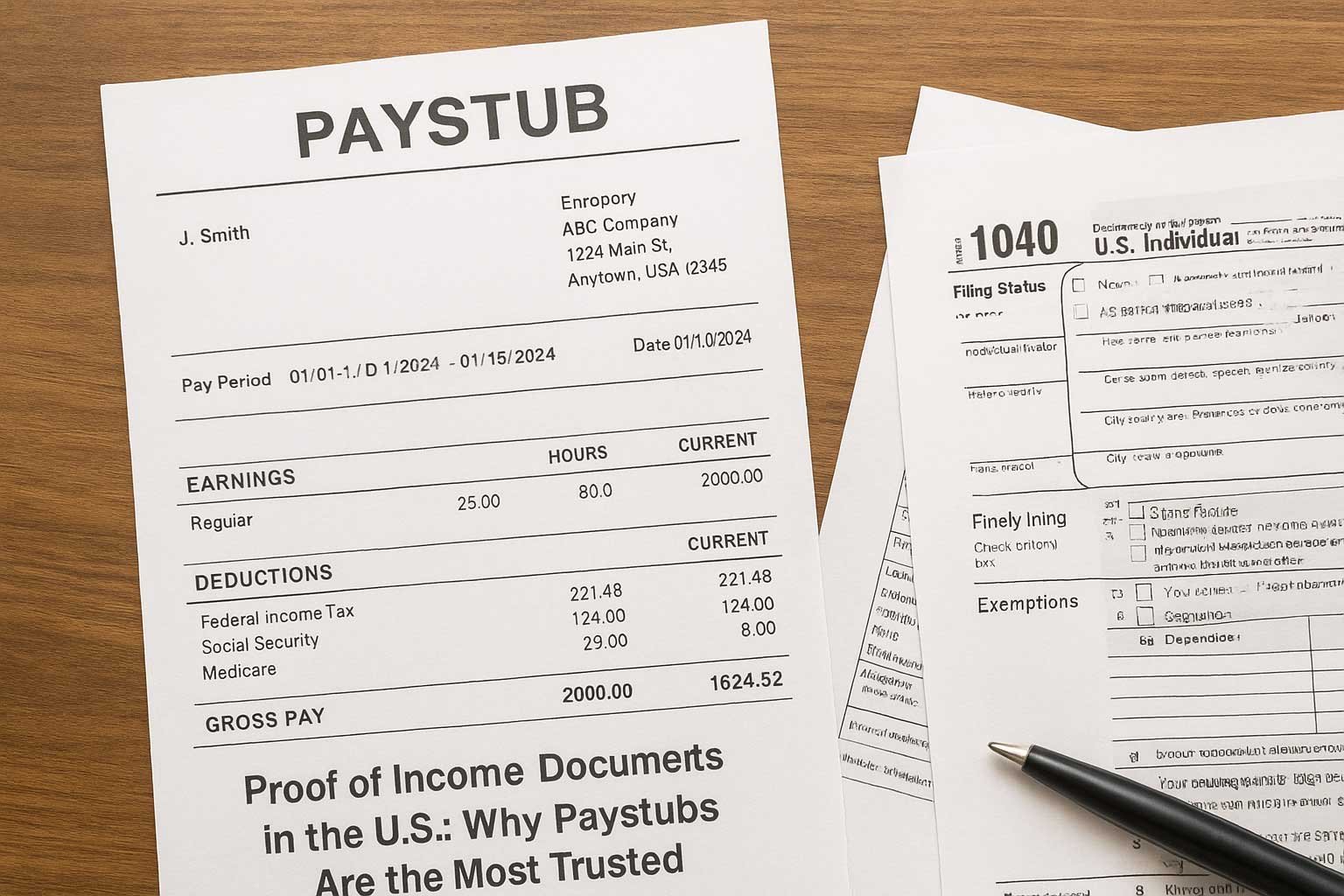

Most people in the United States will make the decision to purchase a home at some point in their lives, and it is one of the most financially significant things you will ever do. There are many steps that need to be completed before buying a home, one of the most important being getting a mortgage. Mortgages allow people to take out a loan in order to finance a home purchase. Because a mortgage is a loan, lenders need to ensure that borrowers are financially responsible. One of the most important documents lenders need to review is the paystub.

Lenders need to determine income stability, work stability, and ability to repay a loan. On the other hand, buyers are able to show their credits scores but need pay documents to show their stability. This article explains the factors involved in the mortgage process and why lenders need some documents and paystubs.

Why Mortgage Lenders Need to See Paystubs

When assessing mortgage options, lenders need to confirm the following:

- you have a steady income

you have a stable job

you are capable of making mortgage payment

the income you make is close to the income stated in the loan application

Most people are able to provide pay documents to lenders stable mortgage payments will be affordable.

How Many Paystubs Are Needed for Mortgage Approval?

Most lenders will ask for the following:

- – 30-60 of the most recent paystubs

– a few lenders ask for 3 months of pay history

– freelancers need to submit income records for the past 2 years

Most lenders are flexible and conside the requirments based on their borrowers.

What Do Lenders Look at on Your Paystub ?

Some things mortgage underwriters look at on pay stubs are:

● People’s gross income

● People’s net income

● Bonuses

● Tax deductions

● How long they’ve been at their job

They also need to look at documents like:

● Bank statements

● Tax documents

● Credit reports

Income Is Always Checked For Stability Rather Than Affordability

Lenders look for things like:

● The same income every month

● Working at the same job for a long time

● Steady job history

Missing job history or multiple job changes can lower the chances for mortgage approval and cause delays.

Freelancers and Self Employed People Looking for Mortgages

Because freelancers:

● Don’t have a boss who gives them pay stubs

● Have income that changes a lot

● Lenders want to see income for a longer time

Freelancers have to show:

● Pay stubs they create

● Bank documents

● Tax documents

● Loss and profit reports

What Generating A Paystub Can Do For Your Mortgage Application

If a person does not have traditional pay stubs, an online generator helps a lot.

With paystub makers, individuals can:

● Make pay stubs that look professional

● Put real income and create deductions

● Download the pdf that lenders will accept

They can help a lot with the mortgage application process.

Common Paystub Problems That Result in Delayed Mortgages

So many mortgage applications get delayed because of all the following issues:

- Paystub detail parts missing

- Income discrepancies

- Unexplained missing values

- Irregular troubling gaps in pay

- Discrepancy with bank deposits

If you stay organized and submit tidy and accurate paystub documents, you can prevent having these problems.

The Effect of Paystubs on Your Mortgage Loan Amount

Your paystub indicates what:

- Loan eligibility you can have

- Your possible mortgage each month

- Your debt to income percent

Loan limits can go up higher if income is verified and is total higher.

Do Online Paystubs Count for Mortgage Approval?

Typically, yes. Online paystub generators should be fine as long as

- Income values match up

- Document is not shady unprofessional

- Data is consistent with what bank statements show

Being consistent and honest is very necessary.

Conclusion

Paystubs are fundamental to mortgage approvals all over America. They allow lenders to confirm income, assess financial security, and determine available loan amounts. The delay and denial of mortgages can immobolize even the strongest financially prospective home buyers in the marketplace without proper paystubs.

For people without paystubs offered by employers, a legitimate paystub generator could be the answer to the problem. That with the right documents, home buyers can pursue home ownership.

FAQ

1. How many paystubs do I need for a mortgage?

Generally, mortgage applicants’ lenders will ask for your last two consecutive paystubs, covering the last 30 days. In addition to the paystubs, W-2 forms covering the last two years will be needed, as well as bank statements. This consistent documentation is needed to calculate your debt-to-income (DTI) ratio in order to verify your employment to the lender.

2. Do freelancers need paystubs for mortgage approval?

No, freelancers do not use traditional paystubs. Self-employed applicants will need and be asked for additional documentation, usually for a period of two years, to show there is stability and consistency. This may include your personal and business tax returns (with built in forms such as the Schedule C and/or K-1), as well as year-to-date Profit and Loss (P&L) statements, and 1099 forms, to name a few. Lenders will average the two-year income to find the ceiling of the mortgage for which you can qualify.

3. Can I use paystubs generated online for home loans?

Yes, as long as the information is accurate and can be verified. For lenders to consider the document, they must think it is legitimate, not just from a credible source. If you work for an employer that gives you digital stubs, or you use a paystub generator like Paystubmakers because your payroll is atypical, the information must be identical to the bank deposits and tax documents (W-2). For home loans, differences are a big visibility because authenticity is very important.

4. What happens if I submit incorrect paystub details?

There are serious consequences if you submit incorrect, misleading, or illegitimate paystub details. In this case lenders will close your case as you are likely going to create legal difficulties as well. To check your stated income lenders will use third-party verification services like The Work Number to cross reference income and employment. If this happens, you is going to be stealthy because the mortgage process is already halted, and you are going to find financing elsewhere like other institutions. You are going to be stealthy because you will have to hide from the rest of them.

5. Do bonuses and overtime count toward mortgage income?

Yes, but only if they are consistent and documented. Overtime, bonuses, and commissions are all eligible to be considered by lenders; however, they are looking for a track record spanning two years where documentation shows that these payments are a regular occurrence and are expected to continue. Lenders typically take a two year average of this income and add it to your base salary. If overtime or bonuses are erratic, inconsistent, or have only recently started, lenders may simply exclude them.