When getting a loan for a home, car, education, or personal use, one document is almost always needed: a recent paystub. With paystubs, lenders can determine how much, if any, income is stable and can be used for repayment. It would be unreasonable for lenders to provide a loan to consumers without looking at income documentation, especially a paystub.

In the absence of paystubs, loans become more difficult or even impossible to approve.

Let’s take a look at what lenders use paystubs to assess.

Lenders use paystubs to verify:

- Thread of gross monthly income

- Itemized net take-home pay

- Stability of employment

- Record of tax deductions

- Payment frequency

Lenders use this information to determine if loans can be paid back without major financial consequences.

In contrast to paystubs, why are statements of accounts not enough?

Bank statements are a poor substitute for employment paystubs. They can show one’s income, however they can not show income sources. With paystubs, pay sources are clearly outlined:

- Who paid you

- What was the pay period

- How much was paid in tax deductions

- What is the net pay after tax deductions

Paystubs have become the most trusted income verification documents because of this. They are essential for loans.

What Loans Require Paystubs?

It is commonplace for paystubs to be required in the following loans:

- Auto loans

- Personal loans

- Home mortgages

- Student loans

- Business loans

In most loans, the verifier of paystub records constitutes a prerequisite to completing any loan application.

Problems Borrowers Face Without Paystubs Borrowers want to apply for loans but do not have pay earnings to show. A few issues they face are:

- Additional documentation

- Many obstacles in the process

- Application increases

- Request for more documents

- Application gets rejected

This problem is more prevalent for freelancers, gig workers, and self-employed individuals. The issues above contribute to making the entire loan process more complicated for individuals without paystub documentation.

How a Paystub Generator Helps With Loan Applications A paystub generator helps individuals enter the relevant information and receive documentation to assist in the loan process.

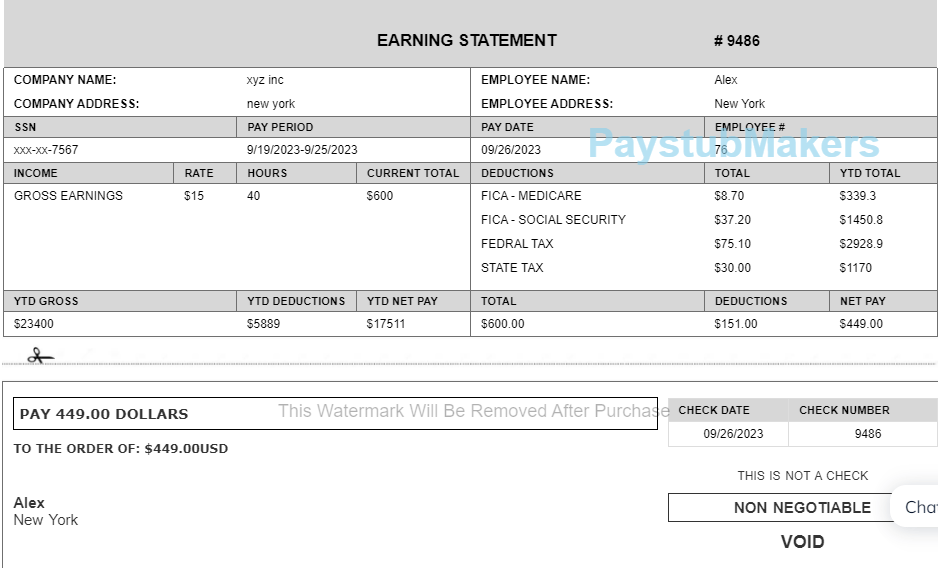

With Paystubmakers, people can:

- Enter their personal and earned income

- Choose a pay period

- Include deductions and taxes

- Receive the paystub in an easy to use PDF

The generated documents can be included for loans without issues.

Tips to Improve Loan Approval With Paystubs

The following is a list of suggestions to help in the process for getting loan approvals:

- Provide paystubs for the last few months

- Show there are no gaps in income for the months

- Provide monthly earnings to show consistency

- Include no errors in the documents (no estimation of the earnings)

- The documents used should be professional

- Keep copies of the documents yourself

Based off the documents and paystubs given to the lender, they will have a better and more accurate understanding of the total earned income for applicants.

Are Online Paystubs Accepted for Loans?

Most of the time, lenders will accept the paystubs as long as the information added is real and accurate.

Final Thoughts The role of income documentation for lenders is crucial. Paystubs show a picture of the borrower’s income, stability and repayment ability. Lenders without proper documentation from potential applicants may be missing out on financially secure applicants.

Paystubmaker makes it easy for users to obtain verifiable professional paystubs to enhance their loan application documents.

FAQs

-

Why do applications for loans and mortgages require paystubs?

Providing paystubs is the most effective and reliable method for verifying income. Financial institutions and lenders in the United States and Canada use it to determine income and ability to pay and/or service a debt.

The lender is assured that the applicant earned money for the pay period in the paystub from a job. The applicant is not self-employed, and can do the job. Also, the lender can tell that the employee is earning a wage and is not in default on their taxes.

Because lenders do not assume any risk and the applicant must meet a lot of mandatory requirements, paystubs must be provided for nearly all loans, mortgages, and credit applications.

-

Why do lenders take the most risk, out of all the points provided to them on a paystub?

Paystubs include all the payments to creditors and, therefore, all the mandatory civil obligations. Also, all on-core or non-recurring payments are made available, which are the ones not needed for daily living like food, nutrition, shelter, and clothing.

Other important points include the amount of time a job has been held and a person’s ability to meet deadlines with respect to the frequency of payment over a period of time.

- Tax Slips: An examination of Canadian (Federal, Provincial, CPP, EI) or US deductions (Federal, State, FICA) confirms that the stated income is valid and within the compliance of the law.

- Year-to-Date (YTD) Earnings: This amount is verified against your income declared and documents filed for taxes (W-2 in the US, T4 in Canada) for complete verification.

-

Why do lenders trust paystubs more than bank statements for income verification?

Although bank statements show deposits, they do not reveal the source or nature of the income. A bank deposit could be a gift, a one-time payment, or the sale of an investment.

Pay stubs provide unique verification of employment and income since they reflect payment for specific employment during a covered pay period along with:

- Identity of the Employer (who made the payment)

- Coverage of the Pay period

- Tax Withholding, which confirms payment of taxes.

- Net Pay, which is actual take-home pay, after all health care, retirement, and other deductions.

For this reason, pay stubs are the most reliable single source document from which to assess ability to repay.

-

How recent must my paystubs be for a typical loan application?

In North America, lenders typically ask for your two most recent, consecutive paystubs. This usually covers the last 30 to 60 days of employment.

- Mortgages: With respect to home loans, lenders commonly request documentation covering the past 30 to 60 days, sometimes paired with a Verification of Employment (VOE) letter from the employer.

- Auto/Personal Loans: Current income can usually be confirmed with the most recent one or two paystubs.

-

I am self-employed or a gig worker. What documentation can I use instead of paystubs?

This is a common scenario. Lenders understand that freelancing, independent contracting (i.e. 1099 work in the US), and sole proprietorship arrangements do not result in traditional employer paystubs. Options include:

- Tax Returns: Filing two years of tax returns is common, particularly the IRS Schedule C in the US and T1 General in Canada.

- Bank Statements: Up to personal and/or business bank statements over 12 or 24 months evidencing a consistent revenue stream.

- Profit & Loss Statements (P&L): Financial statements prepared by a professional.

- Contract Documents: Copies of service agreements that specify the payment terms and that constitute a steady stream of work.

-

Do U.S. and Canadian lenders accept paystubs created by an online service?

Yes, online paystubs are accepted, but there are two requirements to consider:

- Truthfulness: The information reported (salary, taxes, deductions) must be accurate, and it must be possible to verify it against bank documents and tax returns.

- Quality: The results must be presented in a well-organized, standardized professional form that would be appropriate for an employee to receive, and it must be in a professional document-format (e.g. PDF).

For freelancers and those who work for employers that do not use paystub generation, there are appropriate online solutions that fulfill the professional requirements, and they provide an online paystub document instantaneously.

-

What are the paystub-related errors lenders see the most that cause delays or declines in the loans they are trying to provide?

Borrowers experience the most delays because of:

- Inconsistency: There is no explanation for why a borrower submits stubs that show wildly varying weekly/monthly income. Stubs must indicate consistency on income to be approved.

- Time and Job Updates: Stubs are older than a 60-day period. Stubs are dated before a recent raise or prior to a job change.

- Quality of the Evidence: There is information in the file that is not clear, the file is a poor quality or it is a blurry image of a document, or information is omitted from the file. The evidence presented must be in a clear, professional document.

- Mismatched Data: YTD earnings on a paystub in relation to the overall declared earnings in a W-2 (US) or T4 (Canada) may trigger regulatory alarms in reference to fraudulent activity.

-

Does the income verification process differ for lenders in Canada to those in the United States?

The main required document (paystubs) is the same, but the documentation differs in other aspects.

| Feature | United States (US) | Canada |

| Primary Tax Slip | W-2 form (end of year) | T4 (Statement of Remuneration Paid) |

| Self-Employment Tax | 1099 Forms (for contractors) | T4A (Statement of Pension, Retirement, Annuity, and Other Income) |

| Additional Documents | Lenders may request bank deposit history or tax transcripts. | Employment lenders ROE or Record of Employment documents, particularly after a short job stint, to substantiate EU for Employment Insurance (EI) benefits. |